What is a Kagi Chart?

A Kagi Chart is a specialized form of technical chart used in financial analysis to depict price movements and trends in a unique manner. These charts also offer insights into market dynamics, such as supply and demand. They usually filter out insignificant fluctuations and focus solely on significant trend changes and reversals.

Unlike traditional charts such as candlestick or bar charts, Kagi Charts are primarily concerned with price direction rather than time, and they offer a distinct visual representation of supply and demand shifts.

For instance, imagine a stock that has been gradually rising in price but then experiences a sudden and significant drop. A Kagi Chart would emphasize this notable price movement while disregarding smaller fluctuations during the gradual rise.

These charts are constructed using a series of vertical lines, referred to as "Kagi lines," that connect pivotal points on the price scale. Kagi Charts dynamically adapt to market conditions, with new lines being drawn only when specific price movements occur, often surpassing a predefined threshold referred to as the "reversal amount" or "box size."

By considering only substantial price movements, Kagi Charts aim to provide a clearer perspective on actual market trends over a long time, disregarding minor fluctuations that can lead to false signals.

The Origin of Kagi Charts

The roots of Kagi Charts trace back to Japan during the 1870s. They were originally developed to analyze the price movement of rice in a visually accessible manner. As rice was a vital component of Japan's agricultural landscape, the need to understand its price dynamics was of paramount importance.

However, the utility of Kagi Charts transcended the rice market as their principles were found beneficial in a broader range of financial markets. Traders from different backgrounds found them adaptable and effective in showing important price changes. This made Kagi Charts an essential part of modern technical analysis.

Steve Nison is a key figure in financial analysis who introduced candlestick charts from Japan to the Western world. Nison also played a big role in making Kagi Charts more well-known. He realized that traders needed new ways to understand markets and highlighted Kagi Charts as an extra tool for traders. These charts could help them see things more clearly when dealing with the complex trading world.

Creating Kagi Charts

Constructing Kagi Charts is a systematic process that captures substantial price movements while filtering out insignificant market noise. Here's a detailed breakdown of the steps involved in creating Kagi Charts:

Gather Historical Price Data

Begin by collecting historical price data for the asset you're analyzing. This data should encompass a series of time periods, like days, weeks, or months, and include essential price points such as opening, closing, high, and low prices.

Define Reversal Criteria

The reversal criteria refer to the conditions that dictate when a new line should be added to the Kagi Chart. In other words, it's the specific price movement required to trigger a change in the direction of the chart's lines. The reversal criteria determine how significant a price movement must be to be considered worthy of representation on the chart.

For instance, if you set a 2% reversal criterion and the price moves more than 2% in the chosen direction, a new line will be added to the chart.

Select Initial Direction

The "initial direction" refers to the starting orientation of the Kagi Chart's lines. This choice is based on the prevailing trend observed in the price movements of the asset being analyzed.

If the asset has been consistently moving in an upward direction over a certain period (an "upward trend"), the initial direction of the Kagi Chart would be set as upward. This means that the initial lines drawn on the chart will extend upwards to represent this prevailing upward trend.

In contrast, if the asset has been consistently moving in a downward direction (a "downward trend"), the initial direction of the Kagi Chart would be set as downward. In this case, the initial lines on the chart will extend downwards to depict the ongoing downward trend.

The initial direction is chosen to align the Kagi Chart with the asset's primary trend. It sets the tone for how the chart will be constructed and how future lines will be added. As price movements continue, the chart's direction might change based on the reversal criteria and significant price shifts.

The initial direction helps provide context to the chart, offering a starting point that reflects the dominant trend observed in the asset's price history.

Identify Pivot Points

Pivot points are specific price levels at which the direction of an asset's price movement changes. These points are markers where an ongoing trend shifts, leading to a new trend. Pivot points are crucial in technical analysis as they indicate potential areas of support or resistance where price reversals or significant movements might occur.

Examine the historical price data closely to pinpoint pivot points where the asset's price movement aligns with the defined reversal criteria. These pivot points are intervals where the prevailing trend might shift, suggesting potential transitions in the asset's price direction.

Draw Kagi Lines

Kagi lines are the key components of a Kagi Chart. These lines represent the price movements of an asset in a simplified and visually distinct manner. Each Kagi line connects two consecutive pivot points on the chart, emphasizing significant price shifts while filtering out minor fluctuations.

The thickness and direction of these lines offer insights into the changing supply and demand dynamics and highlight key trend changes and reversals.

Begin drawing vertical lines on the chart using the identified pivot points. Each line extends in the chosen direction (upward or downward) and represents the price movement that triggered its creation.

Confirm Reversals

Confirming reversals involves observing whether the Kagi Chart's direction is changing. To achieve this, you need to look for a notable price movement in the opposite direction of the current trend. This movement should meet the criteria you established earlier. When such a significant change occurs, it indicates a shift in market sentiment.

Exclude Small Movements

Kagi Charts omit minor price fluctuations that do not meet the reversal criteria. This exclusion prevents the chart from being cluttered with insignificant price changes and focuses on significant movements.

Disregarding minor shifts ensures the chart doesn’t become cluttered with insignificant data that may not have a substantial impact on the market trend. Instead, the chart focuses on significant price movements that are more likely to reflect supply and demand dynamics shifts and provide a clearer representation of market sentiment.

Ensure Dynamic Chart Construction

Unlike fixed-time interval charts, where new data points are added regularly regardless of market activity, Kagi Charts only introduce new lines when a specific condition is met. This condition, known as the "predetermined price movement," sets a threshold that a price change must surpass to warrant a new line on the chart.

Kagi Charts manage to avoid noise and insignificant fluctuations that might obscure the broader trends. Instead, they focus on representing shifts in supply and demand that significantly impact the market sentiment.

Interpret Trend Changes

Analyze the thickness and direction of the Kagi lines to interpret changes in market trends. The thickness of a line gives us a hint about the size of the price movement. Thicker lines mean bigger price changes – these are the moments when there's a significant shift in demand or supply.

The direction the lines go in tells us whether the market is going up or down. If most lines go up, it's a sign of an upward trend – people generally buy more. If lines are heading down, it's a hint that the market might be in a downward trend – people are selling more.

Combining the thickness and direction of the lines gives a better understanding of market trends. Thicker lines depict heightened market activity, and the overall direction offers insights into the market’s sentiment, whether marked positive (up) or negative (down).

Combine with Additional Analyses

The utility of Kagi Charts can be further improved by combining them with other technical analysis tools. For instance, overlaying trendlines, moving averages, or oscillators can offer a more comprehensive perspective on market trends and potential entry/exit points.

These comprehensive steps can help create Kagi Charts that provide actionable insights into an asset's price trends and significant movements. This technique enables traders and analysts to filter out market noise effectively and focus on the essential dynamics driving supply, demand, and sentiment shifts.

Applications of Kagi Charts

Kagi Charts find diverse applications in financial analysis and trading strategies. Their unique characteristics make them a valuable tool for understanding market trends and making informed decisions. Here are some key applications of Kagi Charts:

Unveiling Trends with Precision

Kagi Charts shine as reliable tools for unveiling trends amidst the bustling world of market fluctuations. Focusing on significant price movements and bypassing minor noise, Kagi Charts provide traders with a panoramic view of prevailing market trends. This deep insight enables traders to promptly recognize supply and demand dynamics shifts, paving the way to identify ongoing trends and potential reversals.

When Kagi lines change direction, it's akin to a market compass pointing to shifts in sentiment. The thickness of these lines further signifies robust price movements, shedding light on intensified buying or selling activities. This precision in trend identification empowers traders to stay ahead of market dynamics, steering clear of insignificant fluctuations while capturing the essence of significant price shifts.

Deciphering Chart Patterns

The uncluttered nature of Kagi Charts facilitates the identification of patterns like reversals, breakouts, and consolidation phases. These patterns act as codes, revealing crucial insights into future price movements.

Reversal patterns, heralded by the dramatic change in the Kagi line direction, foreshadow potential turning points in the market. Breakout patterns, characterized by lines breaching previous highs or lows, offer a glimpse into imminent shifts in price direction. Consolidation phases, marked by narrower lines, hint at periods of market indecision before significant movements.

These patterns serve as strategic signposts for traders, guiding them in projecting price trajectories and shaping their trading decisions.

Precision Entry and Exit Points

Incorporating Kagi Charts alongside technical analysis tools empowers traders to pinpoint optimal entry and exit points accurately. The thickness and direction of Kagi lines, coupled with indicators like moving averages, become a dynamic duo for traders.

Thick lines underscore pronounced price movements, signifying potential entry points when aligned with favorable market conditions. Conversely, thin lines could indicate impending exit points, prompting traders to consider closing positions. This synergy of Kagi Charts and complementary tools provides traders with a comprehensive approach to fine-tuning their trading strategies.

Long-Term Perspective

Kagi Charts take on the role of reliable compasses when navigating the long-term market landscape. Focusing on substantial price movements over time, Kagi Charts sidestep the distractions of short-term volatility. This quality makes them particularly suitable for identifying enduring trends and making informed long-term investment decisions. The simplicity of Kagi Charts and their ability to highlight significant price shifts make them an invaluable tool for strategic long-term planning.

Interpreting Volatility

The thickness and direction of Kagi lines also offer a visual portrayal of market volatility, a concept representing the degree of price variability over time. When lines appear thicker on the chart, it signifies periods with more pronounced price fluctuations. These phases entail rapid market sentiment and asset price shifts, capturing traders' attention.

Conversely, thinner lines indicate reduced price variability intervals, pointing toward relative market stability. This dynamic presentation of volatility equips traders with a tool to gauge market conditions.

By observing the varying thickness of lines, traders gain insights into the current level of price unpredictability. This awareness enables them to fine-tune their strategies, adjusting their approach based on the perceived degree of market turbulence.

Filtering Market Noise

Kagi Charts focus exclusively on substantial price shifts, sidestepping insignificant fluctuations that might clutter other types of charts. This selectivity grants traders a clear view of the overarching market trend, which plays a pivotal role in helping traders sidestep misleading signals arising from minor price adjustments.

By affording traders a focused perspective, Kagi Charts contribute to more accurate decision-making, enabling traders to focus on meaningful trends rather than being led astray by trivial market oscillations.

Enhancing Confirmation

Kagi Charts go beyond their visual representation to enhance the reliability of trading decisions. They are efficient tools combined with other chart types like candlestick or bar charts.

When trends or signals align across different chart formats, it adds more confidence to trading determinations. This confirmation helps traders make informed decisions, minimizing the potential for false signals.

By utilizing Kagi Charts and other charting techniques, traders can make more assured choices based on a well-rounded market trends perspective.

Adaptability Across Markets

Kagi Charts have proven valuable for analyzing stocks, commodities, forex, and more. Their adaptability transcends boundaries, underlining their enduring significance in modern financial analysis. This applicability speaks to the universal nature of Kagi Charts in capturing meaningful price dynamics across various trading arenas.

Comparing Assets

Traders utilize Kagi Charts for the comparative analysis of different assets. This approach helps them gain valuable insights into the relative performance of various options.

By comparing Kagi Charts of distinct assets, traders better understand strengths and weaknesses. This practice provides a strategic advantage, aiding in identifying promising investment opportunities in the diversity of the market.

Educational Value

Kagi Charts serve as educational tools that facilitate the comprehension of price dynamics and the intricate interplay between supply and demand. The visual representation they offer serves as a bridge to understanding market scenarios.

This approach enriches the learning experience for traders and analysts, enabling them to navigate the complexities of financial markets with greater insight and comprehension.

Pros and Cons of Kagi Charts

Kagi Charts bring a unique approach to technical analysis, offering distinct advantages and potential drawbacks. Understanding both the strengths and limitations of Kagi Charts is crucial for making informed decisions when incorporating them into trading strategies.

Pros

- Clarity in Trends: Kagi Charts excel in highlighting significant price movements, providing a clear view of prevailing trends while filtering out minor fluctuations. This clarity aids in quick trend identification.

- Noise Reduction: Focusing on substantial price shifts, Kagi Charts help traders avoid false signals generated by market noise, contributing to more accurate trading decisions.

- Pattern Recognition: The uncluttered nature of Kagi Charts makes it easier to identify chart patterns such as reversals, breakouts, and consolidation phases, enabling traders to make strategic predictions.

- Long-Term Analysis: Kagi Charts are well-suited for long-term analysis, helping traders identify enduring trends and make informed investment decisions over extended periods.

Cons

- Lack of Time Dimension: Kagi Charts do not incorporate a time axis, limiting their ability to determine the duration of price movements precisely.

- Omission of Price Gaps: Kagi Charts do not account for price gaps, potentially leading to gaps in the visual representation of price movements.

- Limited Indicator Integration: Integrating Kagi Charts with traditional indicators can be challenging due to the absence of fixed time intervals.

- Potential Complexity: Interpreting Kagi Charts requires familiarity with their specific construction rules, which might be more complex than other chart types.

Final Thoughts

Kagi Charts are a dynamic tool that offers a unique perspective on market trends and price movements. Their ability to clarify significant price shifts while filtering out noise equips traders with a sharper view of market dynamics. Kagi Charts excel in trend identification, pattern recognition, and comparative analysis across diverse markets as a complementary addition to technical analysis.

However, it's important to remember that while Kagi Charts possess strengths such as clarity and adaptability, they also come with limitations like the absence of a time dimension and potential complexity in interpretation. Effective utilization of Kagi Charts involves integrating them with other analytical tools to create a more holistic understanding of market behavior.

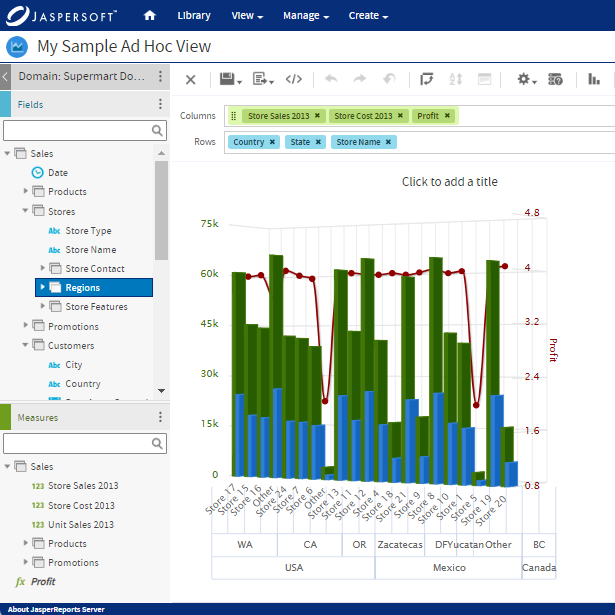

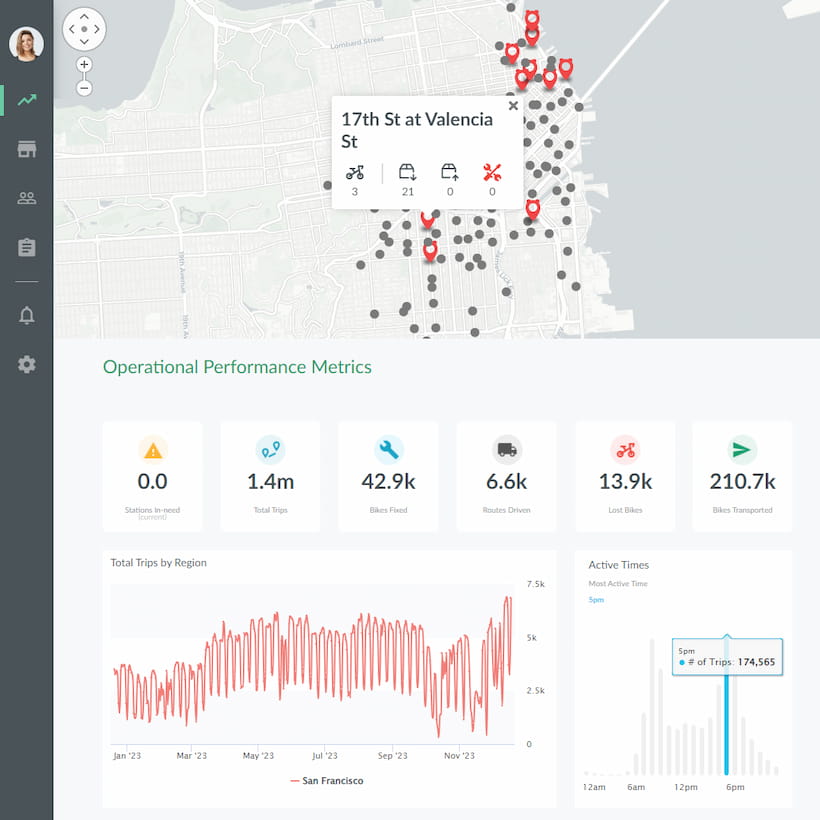

Kagi Charts with Jaspersoft

Related Resources

Jaspersoft in Action: Embedded BI Demo

See everything Jaspersoft has to offer – from creating beautiful data visualizations and dashboards to embedding them into your application.

Creating Addictive Dashboards

Learn how to build dashboards that your users will love. Turn your data into interactive, visually engaging metrics that can be embedded into your web application.